Subsidized vs unsubsidized loans – what’s the difference

With college acceptance deadlines approaching, I recently received a phone call from a parent asking about college loans, particularly what is the difference between Subsidized and unsubsidized loans, and how much of each should they take out? There are several different variables that may come into play in the answer, but here are some general guidelines. [continue reading]

Your school will send you an award letter that lists different types and amounts of financial aid you’re eligible for. This could include grants, scholarships, work-study funds, or student loans. You might see two types of federal student loans in your letter: Direct Unsubsidized Loan and Direct Subsidized Loan. Some people refer to these loans as Stafford Loans or Direct Stafford Loans or just subsidized and unsubsidized loans. It’s important you know the basics about these two types of loans before you sign to accept either of them.

How are they similar?

Both are federal student loans offered by the U.S. Department of Education. To be eligible to receive either of them, you must be enrolled at least half-time at your school. Both loans offer a six-month grace period before you’re required to begin repaying them.

How are they different?

The major differences are interest and how much you can borrow. For subsidized loans, you won’t be charged interest while you’re enrolled in school and during your grace period (about six months). For unsubsidized loans, interest starts accruing (accumulating) from the date of your first loan disbursement. For both types of loans, the amount you can borrow is determined by your school, and they use several pieces of information to calculate your aid.

Which loan should I accept?

If you need to accept loans to help cover the cost of college or career school, remember to borrow only what you need. You should accept the subsidized loan first because it has more benefits. If you have to accept an unsubsidized loan, remember that you’re responsible for all the interest that accrues on that loan.

What if I don’t need the entire loan amount?

You don’t have to accept all the student loans offered to you! It’s OK to accept a lower amount than what you see in your award letter, just talk to the financial aid office at your school. If you need more money later in the year, your school can give you more loan money.

What should I do if I have unsubsidized loans?

Consider making interest payments right away if you can—it will save you money in the long run. This is because when you graduate or leave college, interest accrued during your time in school gets added to your principal loan amount. So, unless you paid your interest while in school, when you’re ready to repay your unsubsidized loan, interest will accrue on a new, higher principal loan amount.

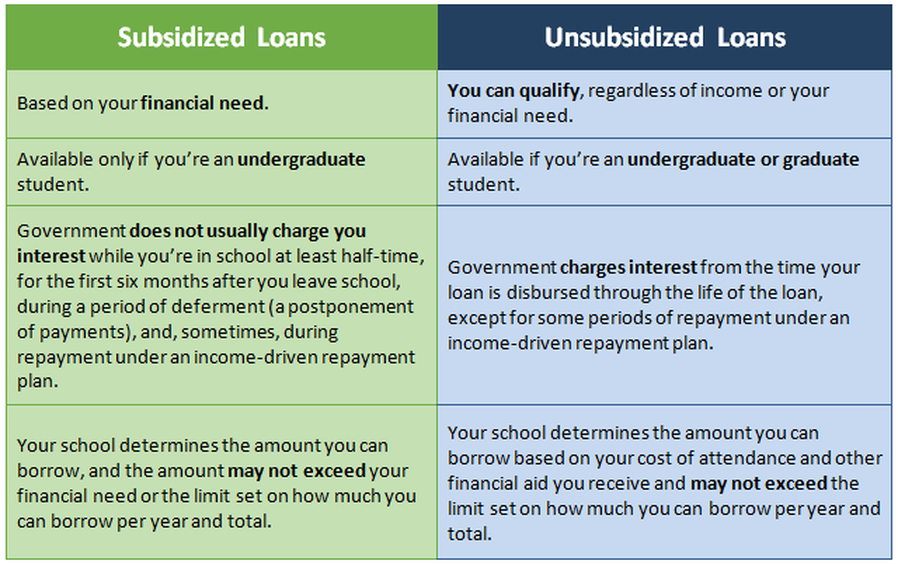

Quick Overview of Direct Subsidized Loans and Direct Unsubsidized Loans

Your school will send you an award letter that lists different types and amounts of financial aid you’re eligible for. This could include grants, scholarships, work-study funds, or student loans. You might see two types of federal student loans in your letter: Direct Unsubsidized Loan and Direct Subsidized Loan. Some people refer to these loans as Stafford Loans or Direct Stafford Loans or just subsidized and unsubsidized loans. It’s important you know the basics about these two types of loans before you sign to accept either of them.

How are they similar?

Both are federal student loans offered by the U.S. Department of Education. To be eligible to receive either of them, you must be enrolled at least half-time at your school. Both loans offer a six-month grace period before you’re required to begin repaying them.

How are they different?

The major differences are interest and how much you can borrow. For subsidized loans, you won’t be charged interest while you’re enrolled in school and during your grace period (about six months). For unsubsidized loans, interest starts accruing (accumulating) from the date of your first loan disbursement. For both types of loans, the amount you can borrow is determined by your school, and they use several pieces of information to calculate your aid.

Which loan should I accept?

If you need to accept loans to help cover the cost of college or career school, remember to borrow only what you need. You should accept the subsidized loan first because it has more benefits. If you have to accept an unsubsidized loan, remember that you’re responsible for all the interest that accrues on that loan.

What if I don’t need the entire loan amount?

You don’t have to accept all the student loans offered to you! It’s OK to accept a lower amount than what you see in your award letter, just talk to the financial aid office at your school. If you need more money later in the year, your school can give you more loan money.

What should I do if I have unsubsidized loans?

Consider making interest payments right away if you can—it will save you money in the long run. This is because when you graduate or leave college, interest accrued during your time in school gets added to your principal loan amount. So, unless you paid your interest while in school, when you’re ready to repay your unsubsidized loan, interest will accrue on a new, higher principal loan amount.

Quick Overview of Direct Subsidized Loans and Direct Unsubsidized Loans