Client letter for November 2015

The clouds part

Bernard Baruch is not a household name, so a quick background is in order. He was a financier, a stock investor, a philanthropist, and an economic advisor to Presidents Woodrow Wilson and Franklin Roosevelt. Baruch once quipped, “The main purpose of the stock market is to make fools of as many men as possible.” While he earned his fortune in an earlier period, few can consistently amass wealth by trying to time the market’s ups and downs. Or, for that matter, ride a few hot stocks and cash in at the right time. [read article]

So from that vantage point, I would agree with Baruch. However, a long-term investment strategy that places cash in large sectors of the U.S. and global economy has historically paid handsome dividends and easily outpaced what might be earned by stashing your money in a CD.

That brings us to the current day. We have seen an interesting turn of events for the market, one that favored the bulls and rewarded those who did not abandon the strategies we recommend. Notably, upward momentum came in a month that historically has a ghoulish reputation. But as I’ll point out shortly, reputation and reality do not always mesh.

We had gotten used to the relatively tranquil seas of the last four years, which passed without a 10% correction in the broad-based S&P 500 Index. But August and September were a blunt reminder that stocks will correct, and sometimes violently.

Nevertheless, basic fundamentals that fueled the bullish run remain in place, including a modest economic recovery and rock-bottom interest rates. Despite a slight downturn in corporate profits, which can be blamed on weakness in the energy sector (FactSet), investors are anticipating a resumption of earnings growth in 2016. I believe that helped limit the downside.

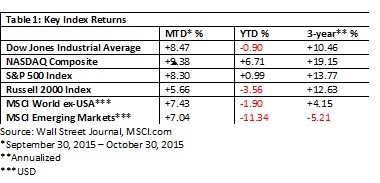

Following the rough waters of August and September, the major market averages have been on a winning streak for the past five weeks (MarketWatch data – through October 30). The strong run-up (Table 1), which saw the Dow Jones Industrials and the S&P 500 Index turn in their best performances since October 2011 (Wall Street Journal, St. Louis Federal Reserve data), have put stocks within hailing distance of their all-time highs.

Bernard Baruch is not a household name, so a quick background is in order. He was a financier, a stock investor, a philanthropist, and an economic advisor to Presidents Woodrow Wilson and Franklin Roosevelt. Baruch once quipped, “The main purpose of the stock market is to make fools of as many men as possible.” While he earned his fortune in an earlier period, few can consistently amass wealth by trying to time the market’s ups and downs. Or, for that matter, ride a few hot stocks and cash in at the right time. [read article]

So from that vantage point, I would agree with Baruch. However, a long-term investment strategy that places cash in large sectors of the U.S. and global economy has historically paid handsome dividends and easily outpaced what might be earned by stashing your money in a CD.

That brings us to the current day. We have seen an interesting turn of events for the market, one that favored the bulls and rewarded those who did not abandon the strategies we recommend. Notably, upward momentum came in a month that historically has a ghoulish reputation. But as I’ll point out shortly, reputation and reality do not always mesh.

We had gotten used to the relatively tranquil seas of the last four years, which passed without a 10% correction in the broad-based S&P 500 Index. But August and September were a blunt reminder that stocks will correct, and sometimes violently.

Nevertheless, basic fundamentals that fueled the bullish run remain in place, including a modest economic recovery and rock-bottom interest rates. Despite a slight downturn in corporate profits, which can be blamed on weakness in the energy sector (FactSet), investors are anticipating a resumption of earnings growth in 2016. I believe that helped limit the downside.

Following the rough waters of August and September, the major market averages have been on a winning streak for the past five weeks (MarketWatch data – through October 30). The strong run-up (Table 1), which saw the Dow Jones Industrials and the S&P 500 Index turn in their best performances since October 2011 (Wall Street Journal, St. Louis Federal Reserve data), have put stocks within hailing distance of their all-time highs.

Seasonality favors the bulls

Since it’s impossible to time the market accurately and consistently, I stress the importance of a consistent and well-crafted financial plan. That said, we can look at historical signals for guidance.

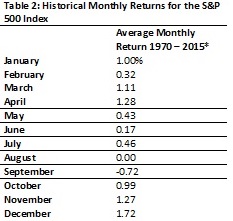

As I mentioned up top, October has an unsettling reputation. The Crash of 1929 and the one-day Crash of 1987 quickly come to mind. More recently, October 2008 was a terrible month for stocks. In reality, October has historically smiled on investors, while September gives cause for the most anxiety – see Table 2. It's important to note, too, that we are heading into a time of year that has been kind to investors – see Table 2 again.

Since it’s impossible to time the market accurately and consistently, I stress the importance of a consistent and well-crafted financial plan. That said, we can look at historical signals for guidance.

As I mentioned up top, October has an unsettling reputation. The Crash of 1929 and the one-day Crash of 1987 quickly come to mind. More recently, October 2008 was a terrible month for stocks. In reality, October has historically smiled on investors, while September gives cause for the most anxiety – see Table 2. It's important to note, too, that we are heading into a time of year that has been kind to investors – see Table 2 again.

Data Source: St. Louis Federal Reserve

*Includes data through October 2015

In fact, on average, two of the three best months since 1970 have occurred in November and December.

Still, these are only averages. Following October’s melt-up in stocks, we may not see another strong run heading into the end of the year. Why such seasonality plays out is unclear. Why August and September tend to be gloomier, why October through May have a tendency to favor the bulls, and why Santa Claus visits investors in December—it's all a bit of a mystery. Some have tried to explain December’s strong performance on the anticipation of cash that may come into the market in the upcoming New Year, but that’s just conjecture.

Looking ahead and possible volatility

There are several variables that may affect equities in the short term and create some volatility heading into the end of the year. Let’s take a look at one.

The on-again, off-again rate hike by the Federal Reserve may be on again following the October meeting. One thing that is certain – it’s been a sub-par economic recovery since the expansion began back in the second half of 2009 (National Bureau of Economic Research). That’s a major reason why the Fed has kept rates near zero. The goal: stimulate borrowing and spending by businesses and consumers, which in turn aids economic activity and job creation. Well, the unemployment rate is back down to 5.1% as of September (U.S. Bureau of Labor Statistics), and the Fed just can’t seem to muster the courage to pull the rate-hike trigger. September seemed to be the ideal time, but global troubles and a drop in the stock market forced the Fed to blink.

Throw in the slowdown in the U.S. economy during the third quarter (U.S. Bureau of Economic Analysis) and investor expectations for a 2015 rate hike had receded. That is until the Fed concluded its late October meeting.

I saw two key takeaways from the October gathering. First, the Fed significantly downplayed global turmoil. Second, while it left a December rate hike on the table (no surprise), the Fed’s statement explicitly said the December meeting might bring about “liftoff,” the term analysts use to describe the first in what is eventually expected to be series fed funds rate increases.

What makes that more significant? It’s the first time the Fed specifically referenced an upcoming meeting. Besides emphasizing that December is still in play, central bankers wanted to prep investors who were growing complacent and had downplayed such a possibility. Fed officials are now crossing their fingers, hoping the economy cooperates and unexpected global turbulence doesn’t resurface.

What does it mean for investors? Focus longer term

I suspect that if rate-hike talk increases over the next couple of months, we are likely to see additional volatility, as the first move in almost ten years has enormous symbolic significance. But it is just that – symbolic. Five years from now, will it really matter if the Fed moved in December versus say in September? Unlikely. The reality is that short-term rates will probably remain near rock bottom levels well after the Fed gradually begins to raise interest rates. If we throw modest economic growth into the mix, we’ve created two strong tailwinds for stocks.

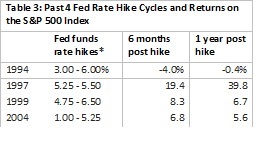

Remember, two of the key components of a bull market are economic growth, which supports profits, and low interest rates, which reduce competition for stocks. Take a look at Table 3, which includes stock market performance during Fed tightening cycles over the last 20 years. Though conventional wisdom suggests higher interest rates hamper equities, the S&P 500 Index managed to rise in three of the four cycles. The aggressive series of increases in 1994, which lasted about a year, only modestly blunted bullish enthusiasm.

*Includes data through October 2015

In fact, on average, two of the three best months since 1970 have occurred in November and December.

Still, these are only averages. Following October’s melt-up in stocks, we may not see another strong run heading into the end of the year. Why such seasonality plays out is unclear. Why August and September tend to be gloomier, why October through May have a tendency to favor the bulls, and why Santa Claus visits investors in December—it's all a bit of a mystery. Some have tried to explain December’s strong performance on the anticipation of cash that may come into the market in the upcoming New Year, but that’s just conjecture.

Looking ahead and possible volatility

There are several variables that may affect equities in the short term and create some volatility heading into the end of the year. Let’s take a look at one.

The on-again, off-again rate hike by the Federal Reserve may be on again following the October meeting. One thing that is certain – it’s been a sub-par economic recovery since the expansion began back in the second half of 2009 (National Bureau of Economic Research). That’s a major reason why the Fed has kept rates near zero. The goal: stimulate borrowing and spending by businesses and consumers, which in turn aids economic activity and job creation. Well, the unemployment rate is back down to 5.1% as of September (U.S. Bureau of Labor Statistics), and the Fed just can’t seem to muster the courage to pull the rate-hike trigger. September seemed to be the ideal time, but global troubles and a drop in the stock market forced the Fed to blink.

Throw in the slowdown in the U.S. economy during the third quarter (U.S. Bureau of Economic Analysis) and investor expectations for a 2015 rate hike had receded. That is until the Fed concluded its late October meeting.

I saw two key takeaways from the October gathering. First, the Fed significantly downplayed global turmoil. Second, while it left a December rate hike on the table (no surprise), the Fed’s statement explicitly said the December meeting might bring about “liftoff,” the term analysts use to describe the first in what is eventually expected to be series fed funds rate increases.

What makes that more significant? It’s the first time the Fed specifically referenced an upcoming meeting. Besides emphasizing that December is still in play, central bankers wanted to prep investors who were growing complacent and had downplayed such a possibility. Fed officials are now crossing their fingers, hoping the economy cooperates and unexpected global turbulence doesn’t resurface.

What does it mean for investors? Focus longer term

I suspect that if rate-hike talk increases over the next couple of months, we are likely to see additional volatility, as the first move in almost ten years has enormous symbolic significance. But it is just that – symbolic. Five years from now, will it really matter if the Fed moved in December versus say in September? Unlikely. The reality is that short-term rates will probably remain near rock bottom levels well after the Fed gradually begins to raise interest rates. If we throw modest economic growth into the mix, we’ve created two strong tailwinds for stocks.

Remember, two of the key components of a bull market are economic growth, which supports profits, and low interest rates, which reduce competition for stocks. Take a look at Table 3, which includes stock market performance during Fed tightening cycles over the last 20 years. Though conventional wisdom suggests higher interest rates hamper equities, the S&P 500 Index managed to rise in three of the four cycles. The aggressive series of increases in 1994, which lasted about a year, only modestly blunted bullish enthusiasm.

Source: St. Louis Federal Reserve

*The fed funds rate at the start and the end of each respective tightening cycle

Bottom line

“All my money is in a savings account. My dad has explained the stock market to me maybe 75 times. I still don't understand it.” So said John Mulaney, a stand-up comedian and a writer on Saturday Night Live.

Admittedly, I chuckled at his comment, but it’s too simplistic, and we all realize what savings accounts are currently offering. I believe Warren Buffett summed it up better when he said, “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

Of course we don’t want to see the stock market close for any extended period of time. What the legendary investor is saying is that he maintains a very long-term time horizon. It’s something that I have consistently counseled.

August and September reminded us that stocks will go through rough patches in the short term. We haven’t experienced a bear market – 20% drop or more – since 2008. The bear will growl again. It’s inevitable. If 200 years of history are a good guide, markets will exit the bear market and soar to new highs. That’s an important lesson to remember when gloom hangs over investors.

But many of you have different goals; therefore, we recommend specific portfolios that take into account various factors. For example, conservative investors aren’t fully exposed to the volatility and potential downside, while long-term investors have a much longer time horizon that allows them to ride out downturns.

I always emphasize that as your financial advisor, it is my job to partner with you. If you have any questions about what I’ve conveyed in this month’s message or want to discuss anything else, I’m simply a phone call away.

I trust that you have found this month’s summary to be beneficial and educational. As always, I am humbled that you have placed your trust in my firm. It is something I never take for granted.

John Davidson, CFP®

john@kyleshill.com

*The fed funds rate at the start and the end of each respective tightening cycle

Bottom line

“All my money is in a savings account. My dad has explained the stock market to me maybe 75 times. I still don't understand it.” So said John Mulaney, a stand-up comedian and a writer on Saturday Night Live.

Admittedly, I chuckled at his comment, but it’s too simplistic, and we all realize what savings accounts are currently offering. I believe Warren Buffett summed it up better when he said, “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

Of course we don’t want to see the stock market close for any extended period of time. What the legendary investor is saying is that he maintains a very long-term time horizon. It’s something that I have consistently counseled.

August and September reminded us that stocks will go through rough patches in the short term. We haven’t experienced a bear market – 20% drop or more – since 2008. The bear will growl again. It’s inevitable. If 200 years of history are a good guide, markets will exit the bear market and soar to new highs. That’s an important lesson to remember when gloom hangs over investors.

But many of you have different goals; therefore, we recommend specific portfolios that take into account various factors. For example, conservative investors aren’t fully exposed to the volatility and potential downside, while long-term investors have a much longer time horizon that allows them to ride out downturns.

I always emphasize that as your financial advisor, it is my job to partner with you. If you have any questions about what I’ve conveyed in this month’s message or want to discuss anything else, I’m simply a phone call away.

I trust that you have found this month’s summary to be beneficial and educational. As always, I am humbled that you have placed your trust in my firm. It is something I never take for granted.

John Davidson, CFP®

john@kyleshill.com