November Letter to Clients: The Final Countdown?

Regardless of anyone’s political leaning, I think we can all agree on one thing. We will all be glad that the election is finally over and we can move on with whatever new reality the election brings. -I always appreciate Facebook postings about whatever great things a friend’s children have done, but I’ll even take watching dog videos over the volume of political “discourse.” Some of you may be concerned, and perhaps rightfully so about the outcome of the election on your investments.

I always caution against watching stocks on a daily basis, because it’s too easy to get caught up in the daily volatility that inevitably will occur. If we go back to last summer’s late August swoon, it might have been tempting to bail when shares were near their bottom and financial reports bordered on hysteria.

Or, fast forward a few months to the start of 2016. Remember how stocks were hit by one worry after another? “The S&P 500 and Nasdaq posted their worst start to a year since 2001, while it was the worst for the Dow since 2008,” according to an early January headline by Reuters. Anytime stock comparisons run up against 2001 or 2008, it’s natural to start asking questions. But it can also generate needless worry.

Monitoring daily moves in stocks may not always show volatility. Instead, it may be as exciting as watching the paint dry. The S&P 500 Index closed at an all-time high 2,190 on August 15 (St. Louis Federal Reserve). We then preceded to close within 3% of the all-time high for the next 54-straight business days ending October 31 (St. Louis Federal Reserve). That’s the longest streak since 1928, according to LPL Research. The sheer boredom in this broad-based index of 500 larger companies contrasts sharply with the circus that has unfolded. You know, the 2016 presidential election.

Charges and counter charges have been levied by the candidates. Reality TV couldn’t have done a better job scripting the antics in this campaign. Sadly, however, this isn’t reality TV. It’s an election that will decide who will be the nation’s commander-in-chief for the next four years. Unless the collective wisdom of investors believes the election will have a material impact on the economy, the lack of market reaction really shouldn’t come as a surprise.

There are some who would say that a come-from-behind win by Donald Trump might spook the market because a win by his opponent, Hillary Clinton, is supposedly priced into shares. That may or may not be the case. A Trump win might produce a “Brexit-like reaction.” You may recall the sharp two-day selloff in shares following the U.K.’s referendum to leave the European Union in June. A ‘yes’ on Brexit wasn’t supposed to happen. That ‘yes’ vote suddenly injected a large dose of uncertainty into the market. But the bottom didn’t fallout of the UK or the EU economy. There weren’t any post-referendum economic tremors to reach our shores either. Within about one month, the major indices in the U.S. were posting new highs.

I can’t say the market will surge to new highs after the election. No one can predict where shares might go in a two or three-week period and do it consistently. But let’s step back a moment and take things into perspective. Short-term market gyrations are the playground of traders. Long-term investors with long-term plans shouldn’t be distracted by daily movements.

Eventually, longer-term money will set its sights on the boring fundamentals that have tugged at shares for many years – the economy, profits and expectations of profit growth, and Federal Reserve policy.

Digging for gold in emerging markets

While performance varies widely from country to country, Russia is up over 30%, and Argentina and Brazil are posting gains of 50% (Wall Street Journal). Brazil comes as a big surprise given a recession and the political chaos that has gripped the nation.

What gives?

Emerging market economies that are reliant on the sale of raw materials have benefited from an uptick in commodity prices. The under-performance in recent years may also be attracting cash from investors who have been discouraged by lackluster growth in the developed world.It comes after years when many investors side-stepped a large swath of the global economy. I typically recommend a well-diversified portfolio that not only places you in the major sectors of the U.S. economy, but I also want to make sure we don’t bypass the global economy, including smaller, developing nations. It’s a way to increase diversification, reduce long-term risk, and participate in gains that emerging markets are likely to see over a long period.

Before anyone wants to run headfirst into emerging markets, a note of caution is in order. I also feel strongly that too much exposure creates too much risk. Investing in these economies is not for the faint of heart. Political risk, currency risk, and economic risk can all exaggerate swings in shares.Longer-term, however, prospects are generally deemed to favorable, and I believe a modest stake in these economies is a worthwhile investment choice, especially as valuations have been attractive.

You paid how much for that?!

Tune into well-known economists and Federal Reserve officials and you’ll hear that one reason interest rates have been slow to rise has been a rate of inflation that’s too low. Yes, you heard it right, prices aren’t rising fast enough. While some of you are thinking about the cheap price of gasoline, others can’t help but point to everything from college and health insurance costs, the latest rise in your cable bill, or even the cost of popcorn at the movies.

Key measures of pricing, such as the Consumer Price Index (CPI) and the lesser known PCE Price Index (the one the Fed prefers), have held below the Fed’s inflation target of 2% for over three years (BLS, BEA). I readily acknowledge that everyone’s monthly basket of goods and services is unique. A person who puts 6,000 miles on her Prius each year won’t benefit nearly as much from lower gasoline prices as the person who racks up 25,000 on her SUV. Still, the major price gauges really do a good job of monitoring the overall price level.

And here lies the disconnect. From an investment perspective, markets (including the stock and bond markets), the Fed, and economists are going to key in on the major indexes such as the CPI and the PCE. That said, the CPI is beginning to detect rising inflation in parts of the economy. In particular, the price paid for services is advancing at a moderate clip, up 3.0% from a year ago (BLS). Notably, medical care has started to rise at a much faster pace, up nearly 5% over the past year, and the cost of shelter (primarily rent as actual home prices aren’t included in the CPI), have accelerated to almost 3.5%.

Despite important pockets of the economy which are experiencing pricing pressures, it is unlikely that we will see much reaction from the Federal Reserve. The Fed’s focus remains on overall economic growth. You see, the Fed wants to keep interest rates low in order to squeeze extra job growth out of the economy. Unfortunately for savers, any interest rate hikes are likely to be gradual unless overall inflation rises sharply.

Epilogue

I know that for some of you, this year’s election has been particularly difficult. You are rightly concerned about the direction of the nation, and you fear the leadership that will take the helm next year won’t be in the country’s best interest. I won’t comment on the many pressing issues of the day, nor will I suggest how to vote, but will leave you with something I wrote just a couple of months ago, and something I wholeheartedly subscribe.

In his 2015 letter to shareholders, Warrant Buffett said, “For 240 years it's been a terrible mistake to bet against America, and now is no time to start. America's golden goose of commerce and innovation will continue to lay more and larger eggs (Bloomberg – Warren Buffett’s 2015 Shareholder letter, Annotated).”

A growing economy fueled by innovation and entrepreneurship has been the biggest driver of stocks over the many decades. As Buffett emphasized, betting against America isn’t a winning hand. And he didn’t qualify his remarks based on the outcome of the upcoming election.

I hope you’ve found this review to be educational and helpful. As I always emphasize, it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me a call.

John Davidson, CFP®

KylesHill Financial Planning

I always caution against watching stocks on a daily basis, because it’s too easy to get caught up in the daily volatility that inevitably will occur. If we go back to last summer’s late August swoon, it might have been tempting to bail when shares were near their bottom and financial reports bordered on hysteria.

Or, fast forward a few months to the start of 2016. Remember how stocks were hit by one worry after another? “The S&P 500 and Nasdaq posted their worst start to a year since 2001, while it was the worst for the Dow since 2008,” according to an early January headline by Reuters. Anytime stock comparisons run up against 2001 or 2008, it’s natural to start asking questions. But it can also generate needless worry.

Monitoring daily moves in stocks may not always show volatility. Instead, it may be as exciting as watching the paint dry. The S&P 500 Index closed at an all-time high 2,190 on August 15 (St. Louis Federal Reserve). We then preceded to close within 3% of the all-time high for the next 54-straight business days ending October 31 (St. Louis Federal Reserve). That’s the longest streak since 1928, according to LPL Research. The sheer boredom in this broad-based index of 500 larger companies contrasts sharply with the circus that has unfolded. You know, the 2016 presidential election.

Charges and counter charges have been levied by the candidates. Reality TV couldn’t have done a better job scripting the antics in this campaign. Sadly, however, this isn’t reality TV. It’s an election that will decide who will be the nation’s commander-in-chief for the next four years. Unless the collective wisdom of investors believes the election will have a material impact on the economy, the lack of market reaction really shouldn’t come as a surprise.

There are some who would say that a come-from-behind win by Donald Trump might spook the market because a win by his opponent, Hillary Clinton, is supposedly priced into shares. That may or may not be the case. A Trump win might produce a “Brexit-like reaction.” You may recall the sharp two-day selloff in shares following the U.K.’s referendum to leave the European Union in June. A ‘yes’ on Brexit wasn’t supposed to happen. That ‘yes’ vote suddenly injected a large dose of uncertainty into the market. But the bottom didn’t fallout of the UK or the EU economy. There weren’t any post-referendum economic tremors to reach our shores either. Within about one month, the major indices in the U.S. were posting new highs.

I can’t say the market will surge to new highs after the election. No one can predict where shares might go in a two or three-week period and do it consistently. But let’s step back a moment and take things into perspective. Short-term market gyrations are the playground of traders. Long-term investors with long-term plans shouldn’t be distracted by daily movements.

Eventually, longer-term money will set its sights on the boring fundamentals that have tugged at shares for many years – the economy, profits and expectations of profit growth, and Federal Reserve policy.

Digging for gold in emerging markets

While performance varies widely from country to country, Russia is up over 30%, and Argentina and Brazil are posting gains of 50% (Wall Street Journal). Brazil comes as a big surprise given a recession and the political chaos that has gripped the nation.

What gives?

Emerging market economies that are reliant on the sale of raw materials have benefited from an uptick in commodity prices. The under-performance in recent years may also be attracting cash from investors who have been discouraged by lackluster growth in the developed world.It comes after years when many investors side-stepped a large swath of the global economy. I typically recommend a well-diversified portfolio that not only places you in the major sectors of the U.S. economy, but I also want to make sure we don’t bypass the global economy, including smaller, developing nations. It’s a way to increase diversification, reduce long-term risk, and participate in gains that emerging markets are likely to see over a long period.

Before anyone wants to run headfirst into emerging markets, a note of caution is in order. I also feel strongly that too much exposure creates too much risk. Investing in these economies is not for the faint of heart. Political risk, currency risk, and economic risk can all exaggerate swings in shares.Longer-term, however, prospects are generally deemed to favorable, and I believe a modest stake in these economies is a worthwhile investment choice, especially as valuations have been attractive.

You paid how much for that?!

Tune into well-known economists and Federal Reserve officials and you’ll hear that one reason interest rates have been slow to rise has been a rate of inflation that’s too low. Yes, you heard it right, prices aren’t rising fast enough. While some of you are thinking about the cheap price of gasoline, others can’t help but point to everything from college and health insurance costs, the latest rise in your cable bill, or even the cost of popcorn at the movies.

Key measures of pricing, such as the Consumer Price Index (CPI) and the lesser known PCE Price Index (the one the Fed prefers), have held below the Fed’s inflation target of 2% for over three years (BLS, BEA). I readily acknowledge that everyone’s monthly basket of goods and services is unique. A person who puts 6,000 miles on her Prius each year won’t benefit nearly as much from lower gasoline prices as the person who racks up 25,000 on her SUV. Still, the major price gauges really do a good job of monitoring the overall price level.

And here lies the disconnect. From an investment perspective, markets (including the stock and bond markets), the Fed, and economists are going to key in on the major indexes such as the CPI and the PCE. That said, the CPI is beginning to detect rising inflation in parts of the economy. In particular, the price paid for services is advancing at a moderate clip, up 3.0% from a year ago (BLS). Notably, medical care has started to rise at a much faster pace, up nearly 5% over the past year, and the cost of shelter (primarily rent as actual home prices aren’t included in the CPI), have accelerated to almost 3.5%.

Despite important pockets of the economy which are experiencing pricing pressures, it is unlikely that we will see much reaction from the Federal Reserve. The Fed’s focus remains on overall economic growth. You see, the Fed wants to keep interest rates low in order to squeeze extra job growth out of the economy. Unfortunately for savers, any interest rate hikes are likely to be gradual unless overall inflation rises sharply.

Epilogue

I know that for some of you, this year’s election has been particularly difficult. You are rightly concerned about the direction of the nation, and you fear the leadership that will take the helm next year won’t be in the country’s best interest. I won’t comment on the many pressing issues of the day, nor will I suggest how to vote, but will leave you with something I wrote just a couple of months ago, and something I wholeheartedly subscribe.

In his 2015 letter to shareholders, Warrant Buffett said, “For 240 years it's been a terrible mistake to bet against America, and now is no time to start. America's golden goose of commerce and innovation will continue to lay more and larger eggs (Bloomberg – Warren Buffett’s 2015 Shareholder letter, Annotated).”

A growing economy fueled by innovation and entrepreneurship has been the biggest driver of stocks over the many decades. As Buffett emphasized, betting against America isn’t a winning hand. And he didn’t qualify his remarks based on the outcome of the upcoming election.

I hope you’ve found this review to be educational and helpful. As I always emphasize, it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me a call.

John Davidson, CFP®

KylesHill Financial Planning

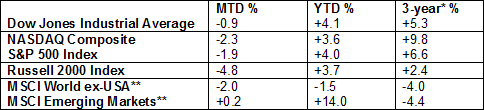

Table 1 Key Index Returns

Source: Wall Street Journal, MSCI.com

MTD returns: Sep 30, 2016—Oct 31, 2016

YTD returns: Dec 31, 2015—Oct 31, 2016

*Annualized

**in US dollars

MTD returns: Sep 30, 2016—Oct 31, 2016

YTD returns: Dec 31, 2015—Oct 31, 2016

*Annualized

**in US dollars