September Letter to Clients: The Ides of September

There is something about October that spooks investors. Maybe it’s the market crash of 1929 or the one-day crash that happened in 1987. More recently, shares were pummeled in October 2008 after Lehman’s collapse roiled global credit markets. Though it has been a while, modest corrections in the late 1970s ruffled feathers in October. Almost 20 years ago, the mini-crash of 1997 that was tied to the economic crisis in Asia played out shortly before Halloween.

However, October’s scary reputation belies reality. Since 1970, the S&P 500 Index has averaged a monthly advance of 0.99% (St. Louis Federal Reserve data). So much for October’s spooky reputation. Over the last 45 years, September has registered an average drop of 0.72%, far below August, which is second from the bottom, or an average return of 0.0%. So, do the math. On average, the broad-based S&P 500 Index has risen in 10 of the 12 months since 1970. Markets really do rise over time, as the data illustrate.

But let’s get back to the month at hand – September. For reasons that aren’t fully understood, it has historically been a tough month for investors. And you can’t just pin September’s lousy performance on a few bad years. Some explanations seem plausible, though they can’t be conclusively proven. According to Investopedia, one theory suggests that summer is usually marked by lighter volume, as investors typically go on vacation and refrain from selling stocks. When they return, they exit shares they had planned to sell. Another camp puts the blame on mutual funds. You see, many mutual funds set their fiscal year end in September. Therefore, fund managers, on average, may decide to sell losing positions before the end of the fiscal year, which leads to September’s subpar performance.

That theory may hold some water. When the index (in this case, the Dow) has been up for the year—as it is now—it usually means the month finishes up, though returns are “still not great,” according to Bespoke Investment Group. In any case, here's the next question that typically comes to mind: “Should I sell in September and re-enter when the long-term averages suggest we’ll be in a more favorable climate for stocks?”

First, be careful with averages, as they are just that–averages. We may consider paring back positions this month, or in any month, but it would have nothing to do with September’s historical weakness and everything to do with your personal circumstances. You see, attempting to time the market, especially short-term ins and outs…and then back-ins, creates a taxable event in non-retirement accounts. More often than not, it’s a net loser and only lengthens the road to your ultimate financial goals. I’m reminded of a comment made by the legendary Warren Buffett, who once quipped, “The only value of stock forecasters is to make fortune-tellers look good.” (CBS – The Smartest Things Ever Said About Market Timing). Or by Peter Lynch, who successfully ran Fidelity’s Magellan Fund during a long period of explosive returns. He noted, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Turn the page and close the chapter on a dull August

How boring is boring, asks LPL Research Group? We may be near a record high, but using closing prices, the S&P 500 traded in a 1.54% range in August–the smallest monthly range since August 1995. In fact, only six months have had a narrower monthly span, going all the way back to 1928!

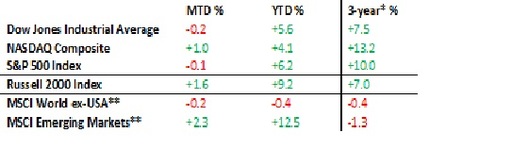

Table 1: Key Index Returns

Source: Wall Street Journal, MSCI.com

MTD returns: July 29, 2016—August 31, 2016

YTD returns: December 31, 2015—August 31, 2016

*Annualized

**in US dollars

A review of the returns for the major averages tells a similar story. The NASDAQ Composite posted a modest gain in August, while the Dow and the S&P 500 inched lower. The term “dog days of summer” could not have been more suitable this year. But August is behind us and we are entering the so-called “dreaded” month of September. What’s in store and what might create a bumpier road, at least in the short term, for investors? While I won’t venture a guess as to where we’ll end the month, let me spend a moment reviewing possible events that could awaken the market from its sleepy August. Before I jump in, let me remind you that I share Warren Buffett’s long-term view. As he said in his 2015 letter to shareholders, “For 240 years, it's been a terrible mistake to bet against America, and now is no time to start. America's golden goose of commerce and innovation will continue to lay more and larger eggs (Bloomberg – Warren Buffett’s 2015 Shareholder letter, Annotated).” But in keeping with our theme, let’s review potential shorter-term risks that may lie before us in this first autumn month.

We’ve been hearing chatter the Federal Reserve might hike interest rates as soon as September. While it seems unlikely the dovish Fed would insert itself into the election by rocking the boat, that possibility exists. If not rates, then what? Record highs signal investors aren’t fretting over the upcoming election. With the exception of the political junkies, voters historically don’t really get engaged until after Labor Day. Yet, a tightening in the race could create additional uncertainty as we head toward November. Then there is the ever-present possibility that international woes could wash up on our shores. Recently, we had a front row seat to the emotional responses wrought by China and Brexit. Once investors realized overseas worries weren’t mucking up the shores of the U.S. economy, cooler heads prevailed.

These are just some of our more recent concerns. I won’t belabor the point by lifting up every rock that might provide a September surprise, but now is a good reminder during the market’s recent calm that volatility can strike. When it does (note, I say “when” not “if”), our financial plan is designed to reduce overall risk while keeping our focus on the long term.

Economy – the good news

I never want to end on a gloomy note. Even during the depths of the Great Recession, we could look up to see the glimmer of distant lights. A quick review of the economic data reveals an economy that has recently gained a bit of momentum. It’s not the fast-paced growth we experienced during the 1980s or the “brimming with confidence” economy of the late 1990s. But the improvements are cautiously encouraging. Though business spending remains weak, employment growth has accelerated (U.S. Bureau of Labor Statistics), weekly first-time jobless claims are holding at historically low levels (Dept. of Labor), and consumer spending has come out of its winter hibernation (U.S. Bureau of Economic Analysis).

While I’m the first to counsel against taking on needless debt for what are needless purchases, consumer spending accounts for 70% of GDP (U.S. BEA). Therefore, a more engaged consumer helps lift the economy. Why does this matter? As I’ve pointed out before, the biggest long-term driver of stock prices is corporate profits, and a growing economy creates a tailwind for profits.

Summary

You’ve heard me say this before–stick to the plan. From a behavioral standpoint, it’s usually easier to adhere to the financial plan when markets are moving higher. If your circumstances have changed, we should talk, as adjustments may be in order. But in any case, you must be comfortable with the level of risk in your portfolio. If you are not, let’s talk and recalibrate.

I hope you’ve found this review to be educational and helpful. As I always emphasize, it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call.

Thank you very much for the trust and confidence you’ve placed in my team and my firm. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.

John A Davidson, CFP®

KylesHill Financial Planning

However, October’s scary reputation belies reality. Since 1970, the S&P 500 Index has averaged a monthly advance of 0.99% (St. Louis Federal Reserve data). So much for October’s spooky reputation. Over the last 45 years, September has registered an average drop of 0.72%, far below August, which is second from the bottom, or an average return of 0.0%. So, do the math. On average, the broad-based S&P 500 Index has risen in 10 of the 12 months since 1970. Markets really do rise over time, as the data illustrate.

But let’s get back to the month at hand – September. For reasons that aren’t fully understood, it has historically been a tough month for investors. And you can’t just pin September’s lousy performance on a few bad years. Some explanations seem plausible, though they can’t be conclusively proven. According to Investopedia, one theory suggests that summer is usually marked by lighter volume, as investors typically go on vacation and refrain from selling stocks. When they return, they exit shares they had planned to sell. Another camp puts the blame on mutual funds. You see, many mutual funds set their fiscal year end in September. Therefore, fund managers, on average, may decide to sell losing positions before the end of the fiscal year, which leads to September’s subpar performance.

That theory may hold some water. When the index (in this case, the Dow) has been up for the year—as it is now—it usually means the month finishes up, though returns are “still not great,” according to Bespoke Investment Group. In any case, here's the next question that typically comes to mind: “Should I sell in September and re-enter when the long-term averages suggest we’ll be in a more favorable climate for stocks?”

First, be careful with averages, as they are just that–averages. We may consider paring back positions this month, or in any month, but it would have nothing to do with September’s historical weakness and everything to do with your personal circumstances. You see, attempting to time the market, especially short-term ins and outs…and then back-ins, creates a taxable event in non-retirement accounts. More often than not, it’s a net loser and only lengthens the road to your ultimate financial goals. I’m reminded of a comment made by the legendary Warren Buffett, who once quipped, “The only value of stock forecasters is to make fortune-tellers look good.” (CBS – The Smartest Things Ever Said About Market Timing). Or by Peter Lynch, who successfully ran Fidelity’s Magellan Fund during a long period of explosive returns. He noted, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Turn the page and close the chapter on a dull August

How boring is boring, asks LPL Research Group? We may be near a record high, but using closing prices, the S&P 500 traded in a 1.54% range in August–the smallest monthly range since August 1995. In fact, only six months have had a narrower monthly span, going all the way back to 1928!

Table 1: Key Index Returns

Source: Wall Street Journal, MSCI.com

MTD returns: July 29, 2016—August 31, 2016

YTD returns: December 31, 2015—August 31, 2016

*Annualized

**in US dollars

A review of the returns for the major averages tells a similar story. The NASDAQ Composite posted a modest gain in August, while the Dow and the S&P 500 inched lower. The term “dog days of summer” could not have been more suitable this year. But August is behind us and we are entering the so-called “dreaded” month of September. What’s in store and what might create a bumpier road, at least in the short term, for investors? While I won’t venture a guess as to where we’ll end the month, let me spend a moment reviewing possible events that could awaken the market from its sleepy August. Before I jump in, let me remind you that I share Warren Buffett’s long-term view. As he said in his 2015 letter to shareholders, “For 240 years, it's been a terrible mistake to bet against America, and now is no time to start. America's golden goose of commerce and innovation will continue to lay more and larger eggs (Bloomberg – Warren Buffett’s 2015 Shareholder letter, Annotated).” But in keeping with our theme, let’s review potential shorter-term risks that may lie before us in this first autumn month.

We’ve been hearing chatter the Federal Reserve might hike interest rates as soon as September. While it seems unlikely the dovish Fed would insert itself into the election by rocking the boat, that possibility exists. If not rates, then what? Record highs signal investors aren’t fretting over the upcoming election. With the exception of the political junkies, voters historically don’t really get engaged until after Labor Day. Yet, a tightening in the race could create additional uncertainty as we head toward November. Then there is the ever-present possibility that international woes could wash up on our shores. Recently, we had a front row seat to the emotional responses wrought by China and Brexit. Once investors realized overseas worries weren’t mucking up the shores of the U.S. economy, cooler heads prevailed.

These are just some of our more recent concerns. I won’t belabor the point by lifting up every rock that might provide a September surprise, but now is a good reminder during the market’s recent calm that volatility can strike. When it does (note, I say “when” not “if”), our financial plan is designed to reduce overall risk while keeping our focus on the long term.

Economy – the good news

I never want to end on a gloomy note. Even during the depths of the Great Recession, we could look up to see the glimmer of distant lights. A quick review of the economic data reveals an economy that has recently gained a bit of momentum. It’s not the fast-paced growth we experienced during the 1980s or the “brimming with confidence” economy of the late 1990s. But the improvements are cautiously encouraging. Though business spending remains weak, employment growth has accelerated (U.S. Bureau of Labor Statistics), weekly first-time jobless claims are holding at historically low levels (Dept. of Labor), and consumer spending has come out of its winter hibernation (U.S. Bureau of Economic Analysis).

While I’m the first to counsel against taking on needless debt for what are needless purchases, consumer spending accounts for 70% of GDP (U.S. BEA). Therefore, a more engaged consumer helps lift the economy. Why does this matter? As I’ve pointed out before, the biggest long-term driver of stock prices is corporate profits, and a growing economy creates a tailwind for profits.

Summary

You’ve heard me say this before–stick to the plan. From a behavioral standpoint, it’s usually easier to adhere to the financial plan when markets are moving higher. If your circumstances have changed, we should talk, as adjustments may be in order. But in any case, you must be comfortable with the level of risk in your portfolio. If you are not, let’s talk and recalibrate.

I hope you’ve found this review to be educational and helpful. As I always emphasize, it is my job to assist you. If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call.

Thank you very much for the trust and confidence you’ve placed in my team and my firm. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.

John A Davidson, CFP®

KylesHill Financial Planning