May Client Letter - Worst-Ever Economy Yet Stocks Show Best Monthly Gain Since '87

Whatever it takes

Within our mandate, the Fed is ready to do whatever it takes to support the economy. Believe me, it will be enough.

Wait, did Fed Chief Jerome Powell really say that? No, he didn’t, but the Fed’s actions seem to have said it for him. Given the speed and force with which the Fed has moved, he might as well have uttered those words. In actuality, it was European Central Bank President Mario Draghi who voiced this promise. In 2012, as Spain and Italy careened towards a financial cliff Draghi gave a speech (Bloomberg News) in which he said: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro.” After a pause, he added firmly, “Believe me, it will be enough.”

In some respects, “whatever it takes” became Draghi’s legacy. No one remembers what he said during the rest of this speech. Just the thought of unlimited central bank firepower encouraged investors to step into Spanish and Italian government debt. Long story short: Another financial crisis was averted. Perhaps the Fed’s rapid response has created the same confidence for American investors. Because despite the tanking economy, markets are fairly robust. Let’s take a deeper look.

The economy: Worst ever

The economy is in a free-fall. Over a six-week period, there have been 30 million first-time claims for unemployment insurance (through April 25) (https://fred.stlouisfed.org/series/ICSA ). It’s by far the worst number of layoffs we’ve ever seen, and it is disheartening to see.

A 7.5% decline in consumer spending in March (https://fred.stlouisfed.org/series/PCE) is the biggest decline on record. Industrial production slid 5.4% in March (https://fred.stlouisfed.org/series/INDPRO# ), the worst decline since the end of World War II.

Nonfarm payrolls for April will be released May 8. It will easily exceed the prior record of two million lost jobs (https://fred.stlouisfed.org/series/PAYEMS#0 ) at the end of World War II. Sadly, we may see an acceleration in the economic contraction this month when April’s data roll in.

“Many standard economic statistics have yet to catch up with the reality we are experiencing,” Powell said at his end-of-April press conference. “Manufacturing output fell sharply in March and is likely to drop more rapidly (in April) as many factories have temporarily closed.” Put simply, a health crisis has morphed into an economic crisis, with the economy contracting at depression-like speed. “The severity of the downturn will depend on the policy actions taken at all levels of government to cushion the blow and support recovery when the crisis passes,” Powell said.

The markets: Best monthly gains since 1987

During April, the Dow Jones Industrial Average and the S&P 500 recorded their best monthly gains since 1987 (https://www.marketwatch.com/story/after-a-blockbuster-april-for-the-dow-and-sp-500-is-sell-in-may-in-the-coronavirus-era-a-smart-strategy-2020-04-30 ). It’s an incredible disconnect between the financial economy and the real economy.

One of the recurrent themes I emphasize is that bull markets occur during economic expansions and bear markets coincide with recessions. Expansions outlast recessions, and expansions drive the economy to higher levels. And stocks follow, albeit unevenly.

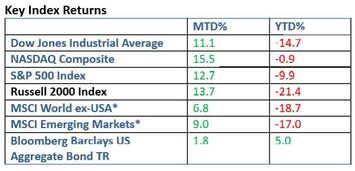

The one glaring exception over the last 50 years was the 1987 market crash, which didn’t lead to an economic contraction. The four-week 34% decline in the S&P 500 (https://fred.stlouisfed.org/series/SP500) qualifies as a bear market. Stocks imploded at a stunning pace as investors sensed the economy was running into a COVID-19 wall. But the rally over the last month has been nothing short of astonishing given today’s dire economic environment. Year-to-date, losses in U.S. stocks have been quite modest, as the table below illustrates.

Within our mandate, the Fed is ready to do whatever it takes to support the economy. Believe me, it will be enough.

Wait, did Fed Chief Jerome Powell really say that? No, he didn’t, but the Fed’s actions seem to have said it for him. Given the speed and force with which the Fed has moved, he might as well have uttered those words. In actuality, it was European Central Bank President Mario Draghi who voiced this promise. In 2012, as Spain and Italy careened towards a financial cliff Draghi gave a speech (Bloomberg News) in which he said: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro.” After a pause, he added firmly, “Believe me, it will be enough.”

In some respects, “whatever it takes” became Draghi’s legacy. No one remembers what he said during the rest of this speech. Just the thought of unlimited central bank firepower encouraged investors to step into Spanish and Italian government debt. Long story short: Another financial crisis was averted. Perhaps the Fed’s rapid response has created the same confidence for American investors. Because despite the tanking economy, markets are fairly robust. Let’s take a deeper look.

The economy: Worst ever

The economy is in a free-fall. Over a six-week period, there have been 30 million first-time claims for unemployment insurance (through April 25) (https://fred.stlouisfed.org/series/ICSA ). It’s by far the worst number of layoffs we’ve ever seen, and it is disheartening to see.

A 7.5% decline in consumer spending in March (https://fred.stlouisfed.org/series/PCE) is the biggest decline on record. Industrial production slid 5.4% in March (https://fred.stlouisfed.org/series/INDPRO# ), the worst decline since the end of World War II.

Nonfarm payrolls for April will be released May 8. It will easily exceed the prior record of two million lost jobs (https://fred.stlouisfed.org/series/PAYEMS#0 ) at the end of World War II. Sadly, we may see an acceleration in the economic contraction this month when April’s data roll in.

“Many standard economic statistics have yet to catch up with the reality we are experiencing,” Powell said at his end-of-April press conference. “Manufacturing output fell sharply in March and is likely to drop more rapidly (in April) as many factories have temporarily closed.” Put simply, a health crisis has morphed into an economic crisis, with the economy contracting at depression-like speed. “The severity of the downturn will depend on the policy actions taken at all levels of government to cushion the blow and support recovery when the crisis passes,” Powell said.

The markets: Best monthly gains since 1987

During April, the Dow Jones Industrial Average and the S&P 500 recorded their best monthly gains since 1987 (https://www.marketwatch.com/story/after-a-blockbuster-april-for-the-dow-and-sp-500-is-sell-in-may-in-the-coronavirus-era-a-smart-strategy-2020-04-30 ). It’s an incredible disconnect between the financial economy and the real economy.

One of the recurrent themes I emphasize is that bull markets occur during economic expansions and bear markets coincide with recessions. Expansions outlast recessions, and expansions drive the economy to higher levels. And stocks follow, albeit unevenly.

The one glaring exception over the last 50 years was the 1987 market crash, which didn’t lead to an economic contraction. The four-week 34% decline in the S&P 500 (https://fred.stlouisfed.org/series/SP500) qualifies as a bear market. Stocks imploded at a stunning pace as investors sensed the economy was running into a COVID-19 wall. But the rally over the last month has been nothing short of astonishing given today’s dire economic environment. Year-to-date, losses in U.S. stocks have been quite modest, as the table below illustrates.

Source: Wall Street Journal, MSCI.com, Morningstar, MarketWatch

MTD: returns: Mar 31, 2020-Apr 30, 2020

YTD returns: Dec 31, 2019-Apr 30, 2020

*in US dollars

How might we explain the disconnect?

The Fed’s unlimited firepower has not been enough to prevent a debilitating economic decline, but its unprecedented steps have kept an economic crisis from morphing into another financial crisis, with a massive amount of liquidity and a promise of more support aiding stocks. Further, government stimulus of over $2.5 trillion is helping sentiment. Talk of a vaccine or treatment that would end the pandemic has been a factor. And, I believe, investors are looking to 2021, when there is the anticipation that corporate profits will turnaround.

Of course, the outlook is very uncertain. Have investors been too optimistic? Additional government spending and support may be needed to jumpstart economic activity, as Powell alluded to in his press conference. Deficit hawks may cringe at talk of new spending and new programs haven’t been problem-free. So far, fiscal stimulus has received strong bipartisan support. Meanwhile, the reopening of large swaths of the economy may or may not go as planned.

Another wildcard will be consumer behavior. Prior patterns are unlikely to return to pre-crisis behavior, at least right away, and social distancing at restaurants, airlines, and industries that require person-to-person interactions could limit activity and sales.

Bottom in sight?

Yet market action suggests some type of economic bottom is in sight. Think of it like this: The level and the direction of stocks is the equivalent of the collective wisdom of millions of small and large investors. They are not simply opinions, but real people and institutions that buy and sell equities, effectively putting their money where their mouth is, as they say.

No one has a crystal ball. No one can tell you where stocks might be at the end of the year. There are too many unknown variables. Those who make forecasts are simply offering opinions. I understand the uncertainty facing all of us. We are grappling with an economic and a health care crisis. It’s something none of us have ever faced. We have addressed various issues with you, but I have an open-door policy. If you have questions or concerns, let’s have a conversation. That’s what I’m here for.

MTD: returns: Mar 31, 2020-Apr 30, 2020

YTD returns: Dec 31, 2019-Apr 30, 2020

*in US dollars

How might we explain the disconnect?

The Fed’s unlimited firepower has not been enough to prevent a debilitating economic decline, but its unprecedented steps have kept an economic crisis from morphing into another financial crisis, with a massive amount of liquidity and a promise of more support aiding stocks. Further, government stimulus of over $2.5 trillion is helping sentiment. Talk of a vaccine or treatment that would end the pandemic has been a factor. And, I believe, investors are looking to 2021, when there is the anticipation that corporate profits will turnaround.

Of course, the outlook is very uncertain. Have investors been too optimistic? Additional government spending and support may be needed to jumpstart economic activity, as Powell alluded to in his press conference. Deficit hawks may cringe at talk of new spending and new programs haven’t been problem-free. So far, fiscal stimulus has received strong bipartisan support. Meanwhile, the reopening of large swaths of the economy may or may not go as planned.

Another wildcard will be consumer behavior. Prior patterns are unlikely to return to pre-crisis behavior, at least right away, and social distancing at restaurants, airlines, and industries that require person-to-person interactions could limit activity and sales.

Bottom in sight?

Yet market action suggests some type of economic bottom is in sight. Think of it like this: The level and the direction of stocks is the equivalent of the collective wisdom of millions of small and large investors. They are not simply opinions, but real people and institutions that buy and sell equities, effectively putting their money where their mouth is, as they say.

No one has a crystal ball. No one can tell you where stocks might be at the end of the year. There are too many unknown variables. Those who make forecasts are simply offering opinions. I understand the uncertainty facing all of us. We are grappling with an economic and a health care crisis. It’s something none of us have ever faced. We have addressed various issues with you, but I have an open-door policy. If you have questions or concerns, let’s have a conversation. That’s what I’m here for.