Planning for People with Special Needs

Parents who have children with special needs have always struggled with providing for their children after their passing. Who will take care of them? Who will pay for all of it? Two significant tools to help in this situation include [Read more…] the Special Needs Trust (SNT), and a relatively new and somewhat more flexible tool, the STABLE Account.

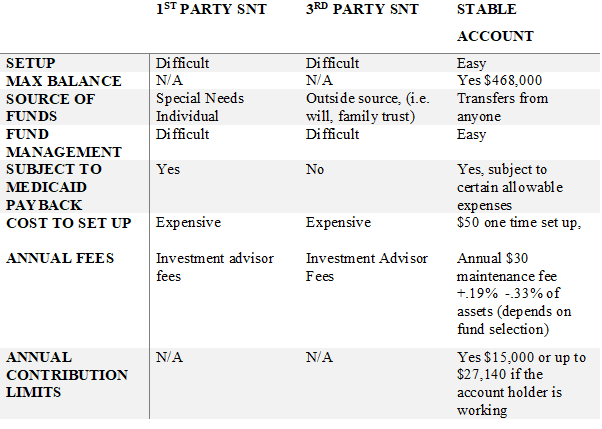

Prior to 2014 the primary way to provide funds for them was a Special Needs Trust (SNT). However, there are limitations on what an SNT can fund. An SNT is an irrevocable trust to benefit individuals with disabilities. SNTs can protect a disabled person’s benefits and allow them to maintain their eligibility for government benefits like Medicaid and SSI. Like all trusts, an SNT must have a settlor (aka grantor), a trustee, and a beneficiary (must have a documented disability). SNT’s differ from STABLE in the fact that they pay for “Comforts and Luxuries”. And typically exclude provisions for other expenses. SNTs may be organized as a first party SNT (funded by the account holder) or third party SNT (funded by an outside source i.e. a will or another trust)

SNT Limitations

Any trust for the benefit of someone receiving means-tested public benefits (like Medicaid waivers and SSI) has some limitations. If trust funds are used to pay for certain things, the beneficiary may lose public benefits or have them reduced. The general rule is that an individual has the capability pay for certain things typically covered by Medicaid or some other government program, then it is not allowed. For this reason, most SNTs limit payments for items known as shelter expenses, i.e. healthcare costs (Medicaid typically would pay), rent, utilities, mortgage payments, and meals.

In 2014, Congress passed the Achieving a Better Life Experience (ABLE) Act, establishing a new type of investment account to provide a new way to provide for broader expenses for individuals with physical and/or mental disabilities (including some mental illnesses). These accounts, established in each individual state (Ohio accounts are called STABLE) allow individuals with disabilities and their loved ones to save, invest and spend money without losing eligibility for certain public benefits programs, like Medicaid or SSI.

Funding the account

Funds in the account can be invested in different portfolios provided by STABLE, similar to Ohio’s College Advantage 529 program. There are however some limitations, there is a $15,000 annual contribution limit from all sources plus an additional $12,140 of earned income if the account holder is working. The contribution year ends on December 31st. No extensions are given. In addition, there is a maximum lifetime contribution limit of $468,000.

Qualified Expenses

The money can be used for any qualified expenses at the time they/you were considered an eligible individual. A qualified expense can be generally described as something that relates to the disability and the expense helps maintain or improve your health, quality of life, and/or independence. Examples include basic living expenses, transportation, and housing. The IRS may ask to verify the expenditures so keep records accordingly. If it is used for non-qualified expenses you must pay regular income taxes, plus a 10% penalty, on the non-qualified portion of funds. Additionally, the non-Qualified funds you withdraw could be counted against the account holder for purposes of determining your eligibility for means-tested public benefits programs, like Medicaid or SSI.

Stable accounts will not affect social security if the account balance remains at or below $100,000. If the account goes above $100,000 then the SSI account will be suspended. Once the account balance drops back below the limit, you can notify SSA to have the SSI benefits reinstated. The money withdrawn must be used for eligible expenses within the same month.

Medicaid payback

Medicaid can file a claim for some amount of repayment if the account holder received Medicaid benefits during the time the account was open (or if rolled over from another ABLE account). This does not mean that Medicaid automatically has the first rights to the money in the individuals STABLE Account after the owner’s death. The account maybe used for several things before Medicaid would be repaid, i.e. funeral & medical expenses.

Taxation

The account earnings are not subject to state and federal tax if funds are spent on qualified expenses. Ohio resident/taxpayers, you can take a state income tax deduction of up to $4,000 per STABLE Account, with unlimited carry forward until your entire contribution has been fully deducted.

Prior to 2014 the primary way to provide funds for them was a Special Needs Trust (SNT). However, there are limitations on what an SNT can fund. An SNT is an irrevocable trust to benefit individuals with disabilities. SNTs can protect a disabled person’s benefits and allow them to maintain their eligibility for government benefits like Medicaid and SSI. Like all trusts, an SNT must have a settlor (aka grantor), a trustee, and a beneficiary (must have a documented disability). SNT’s differ from STABLE in the fact that they pay for “Comforts and Luxuries”. And typically exclude provisions for other expenses. SNTs may be organized as a first party SNT (funded by the account holder) or third party SNT (funded by an outside source i.e. a will or another trust)

SNT Limitations

Any trust for the benefit of someone receiving means-tested public benefits (like Medicaid waivers and SSI) has some limitations. If trust funds are used to pay for certain things, the beneficiary may lose public benefits or have them reduced. The general rule is that an individual has the capability pay for certain things typically covered by Medicaid or some other government program, then it is not allowed. For this reason, most SNTs limit payments for items known as shelter expenses, i.e. healthcare costs (Medicaid typically would pay), rent, utilities, mortgage payments, and meals.

In 2014, Congress passed the Achieving a Better Life Experience (ABLE) Act, establishing a new type of investment account to provide a new way to provide for broader expenses for individuals with physical and/or mental disabilities (including some mental illnesses). These accounts, established in each individual state (Ohio accounts are called STABLE) allow individuals with disabilities and their loved ones to save, invest and spend money without losing eligibility for certain public benefits programs, like Medicaid or SSI.

Funding the account

Funds in the account can be invested in different portfolios provided by STABLE, similar to Ohio’s College Advantage 529 program. There are however some limitations, there is a $15,000 annual contribution limit from all sources plus an additional $12,140 of earned income if the account holder is working. The contribution year ends on December 31st. No extensions are given. In addition, there is a maximum lifetime contribution limit of $468,000.

Qualified Expenses

The money can be used for any qualified expenses at the time they/you were considered an eligible individual. A qualified expense can be generally described as something that relates to the disability and the expense helps maintain or improve your health, quality of life, and/or independence. Examples include basic living expenses, transportation, and housing. The IRS may ask to verify the expenditures so keep records accordingly. If it is used for non-qualified expenses you must pay regular income taxes, plus a 10% penalty, on the non-qualified portion of funds. Additionally, the non-Qualified funds you withdraw could be counted against the account holder for purposes of determining your eligibility for means-tested public benefits programs, like Medicaid or SSI.

Stable accounts will not affect social security if the account balance remains at or below $100,000. If the account goes above $100,000 then the SSI account will be suspended. Once the account balance drops back below the limit, you can notify SSA to have the SSI benefits reinstated. The money withdrawn must be used for eligible expenses within the same month.

Medicaid payback

Medicaid can file a claim for some amount of repayment if the account holder received Medicaid benefits during the time the account was open (or if rolled over from another ABLE account). This does not mean that Medicaid automatically has the first rights to the money in the individuals STABLE Account after the owner’s death. The account maybe used for several things before Medicaid would be repaid, i.e. funeral & medical expenses.

Taxation

The account earnings are not subject to state and federal tax if funds are spent on qualified expenses. Ohio resident/taxpayers, you can take a state income tax deduction of up to $4,000 per STABLE Account, with unlimited carry forward until your entire contribution has been fully deducted.

STABLE in conjunction with a SNT.

For some people there is a benefit to having both a Special Needs Trust and an ABLE Account. STABLE Accounts and SNTs are both designed to fund qualified expenses for those with disabilities. Depending on the circumstances people might start with an ABLE account and then add an SNT later or vice versa. Another strategy to utilize an SNT to contribute into a STABLE account, which could then be used for shelter expenses without effecting eligibility.

As with any planning strategy or investment vehicle, you should consult your financial advisor as well as your tax accountant and attorney to determine which type of account will meet your particular needs given your own circumstances. We are always available to answer questions and help find the best overall solution.

Useful links

Determining Eligibility www.stableaccount.com/eligibility

Open an Ohio ABLE Account www.stableaccount.com

Review Investment Options www.stableaccounts.com/faq

For some people there is a benefit to having both a Special Needs Trust and an ABLE Account. STABLE Accounts and SNTs are both designed to fund qualified expenses for those with disabilities. Depending on the circumstances people might start with an ABLE account and then add an SNT later or vice versa. Another strategy to utilize an SNT to contribute into a STABLE account, which could then be used for shelter expenses without effecting eligibility.

As with any planning strategy or investment vehicle, you should consult your financial advisor as well as your tax accountant and attorney to determine which type of account will meet your particular needs given your own circumstances. We are always available to answer questions and help find the best overall solution.

Useful links

Determining Eligibility www.stableaccount.com/eligibility

Open an Ohio ABLE Account www.stableaccount.com

Review Investment Options www.stableaccounts.com/faq