December Letter to Clients: Near Term Impact of Trump's Victory

What is supposed to happen and what actually happens do not always correlate. Donald J. Trump will soon be our next president. A Trump win was supposed to shake markets, given all the uncertainty surrounding his incendiary rhetoric and vague policy proposals. Hillary Clinton represented continuity, even if her platform wasn’t always viewed as business friendly.

Well, stocks crumbled in overnight trading (primarily accessed by professionals and not individual investors) as the vote count signaled a Trump win (Bloomberg). On Wednesday, stocks closed sharply higher. Soon, the major indexes would hit new highs (Wall Street Journal). Conciliatory speeches by The Donald and Hillary seemed to soothe nerves. But markets quickly turned to the fundamentals, and prospects that a Republican Congress and a Republican president would enact pro-business and pro-growth measures forced a sharp shift in sentiment. Talk of higher infrastructure spending, a cut in the corporate tax rate, and cuts in individual tax cuts were viewed as positives. Yes, it’s early and nothing is set in stone, but economic stimulus that is expected to boost the economy and profits pushed the major indices to new highs (Barron’s).

However, the prospect of higher deficit spending, and with it, the possibility that inflation could tick higher, have taken a big toll on Treasuries and investment grade bonds. How a Trump presidency will unfold is up for debate. But the unexpected reaction in stocks is a good example of how even the savviest market-timing strategies don’t always play out as expected.

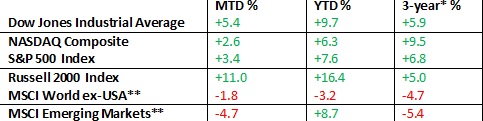

Table 1: Key Index Returns

Well, stocks crumbled in overnight trading (primarily accessed by professionals and not individual investors) as the vote count signaled a Trump win (Bloomberg). On Wednesday, stocks closed sharply higher. Soon, the major indexes would hit new highs (Wall Street Journal). Conciliatory speeches by The Donald and Hillary seemed to soothe nerves. But markets quickly turned to the fundamentals, and prospects that a Republican Congress and a Republican president would enact pro-business and pro-growth measures forced a sharp shift in sentiment. Talk of higher infrastructure spending, a cut in the corporate tax rate, and cuts in individual tax cuts were viewed as positives. Yes, it’s early and nothing is set in stone, but economic stimulus that is expected to boost the economy and profits pushed the major indices to new highs (Barron’s).

However, the prospect of higher deficit spending, and with it, the possibility that inflation could tick higher, have taken a big toll on Treasuries and investment grade bonds. How a Trump presidency will unfold is up for debate. But the unexpected reaction in stocks is a good example of how even the savviest market-timing strategies don’t always play out as expected.

Table 1: Key Index Returns

Source: Wall Street Journal, MSCI.com

MTD returns: Oct 31, 2016—Nov 30, 2016

YTD returns: Dec 31, 2015—Nov 30, 2016

*Annualized

**in US dollars

I'm here to help

Let me emphasize again that it is my job to assist you! If you have any questions or would like to discuss any matters, please feel free to give me a call. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.

MTD returns: Oct 31, 2016—Nov 30, 2016

YTD returns: Dec 31, 2015—Nov 30, 2016

*Annualized

**in US dollars

I'm here to help

Let me emphasize again that it is my job to assist you! If you have any questions or would like to discuss any matters, please feel free to give me a call. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.