A September Pothole and the 2020 Election

The S&P 500 Index surged an impressive 60% from the March 23 bottom to the most recent high in early September (St. Louis Fed S&P 500 data). But stocks hit a roadblock in September. Given the incredible run, a pullback was inevitable. But as I’ve counseled before, the timing, magnitude and duration of a pullback is impossible to predict. Your success is based, at least in part, on time in the market, not timing the market.

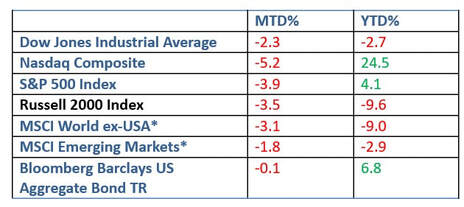

Source: Wall Street Journal, MSCI.com, Morningstar, MarketWatch

MTD return: Aug 31, 2020-Sep 30, 2020

YTD return: Dec 31, 2019-Sep 30, 2020

There were several factors that played a role in last month’s pullback.

President Trump and the first lady tested positive for Covid, injecting a new round of uncertainty into an already tumultuous election. How this may play out is unknown, as we’re in uncharted waters. Much will depend on the path of the virus, but heightened uncertainty does put a damper on investor sentiment.

Amid acrimony on both sides, let me first say that my role is to be your financial advisor. I have worked hard to earn your trust. I am not a political analyst. I am here to guide you as you journey toward your financial goals.

Therefore, I will carefully and cautiously review the current contest through a very narrow prism–through the eyes of a dispassionate investor focused on the economic fundamentals and how that might impact equities.

Let’s consider these facts.

Longer term, stocks march to the beat of the economy, Fed policy and corporate profits. A growing economy fueled by innovation and entrepreneurship has been the biggest driver of stocks over the many decades. In my opinion, that’s not about to change.

I trust you’ve found this review to be helpful and educational. We have addressed various issues with you, but I have an open-door policy. If you have questions or concerns, let’s have a conversation. That’s what I’m here for.

MTD return: Aug 31, 2020-Sep 30, 2020

YTD return: Dec 31, 2019-Sep 30, 2020

There were several factors that played a role in last month’s pullback.

- Any uncertainty creates a good excuse to take profits after a big run-up in price.

- Daily Covid cases in the U.S. ticked higher last month, per Johns Hopkins data.

- While it won’t be cheap, Congress has yet to find common ground on a new fiscal stimulus bill. The economic bounce in Q3 has been much stronger than most initially thought possible. But investors and many analysts believe more support is needed.

- Finally, the election is front and center. We may not have a winner on election night. Worse, a disputed election would add to investor angst.

President Trump and the first lady tested positive for Covid, injecting a new round of uncertainty into an already tumultuous election. How this may play out is unknown, as we’re in uncharted waters. Much will depend on the path of the virus, but heightened uncertainty does put a damper on investor sentiment.

Amid acrimony on both sides, let me first say that my role is to be your financial advisor. I have worked hard to earn your trust. I am not a political analyst. I am here to guide you as you journey toward your financial goals.

Therefore, I will carefully and cautiously review the current contest through a very narrow prism–through the eyes of a dispassionate investor focused on the economic fundamentals and how that might impact equities.

Let’s consider these facts.

- Stocks have performed well under both parties.

- The conventional wisdom isn’t always right. Recall that stocks weren’t supposed to do well with a Trump win, as investors wanted the continuity a Hillary Clinton presidency would offer.

- Compromise and gridlock may engulf a dominant party, as a one-sided win tends to expose party divisions. Remember how Republicans would quickly repeal Obamacare?

Longer term, stocks march to the beat of the economy, Fed policy and corporate profits. A growing economy fueled by innovation and entrepreneurship has been the biggest driver of stocks over the many decades. In my opinion, that’s not about to change.

I trust you’ve found this review to be helpful and educational. We have addressed various issues with you, but I have an open-door policy. If you have questions or concerns, let’s have a conversation. That’s what I’m here for.